Salary Sacrifice vs Company Car

A full breakdown of salary sacrifice and company car schemes.

Salary Sacrifice vs Company Car: What's Best for You in 2025?

Car options through work can sound a bit confusing, but we promise it's not that complicated.

This guide will help you understand the difference between salary sacrifice and company cars, and which one might be right for you. We've broken it up into sections so you can jump to what matters to you.

If you're completely new to all this, it's worth starting from the beginning! Any questions, we're always on hand to help.

What is a Salary Sacrifice Car Scheme?

Salary sacrifice is basically where you give up a bit of your salary before tax to get a brand-new lease car. Because the money comes out before the taxman gets his hands on it, you can save quite a bit - especially if you go for an electric car!

You pay a fixed monthly amount for the car over a time period you agree to, based on how many miles you think you'll do each year (don't worry, you can change this later if you need to).

The cost usually includes things like road tax, and you can even add maintenance packages that cover servicing and tyres if you want to keep things simple.

What is a Company Car?

A company car is pretty straightforward - your work gives you a car as part of your job or benefits. They sort out the car and you get to use it for work and your own stuff too.

You do have to pay what's called Benefit-in-Kind (BiK) tax on it though. How much depends on what the car costs and how much CO₂ it pumps out.

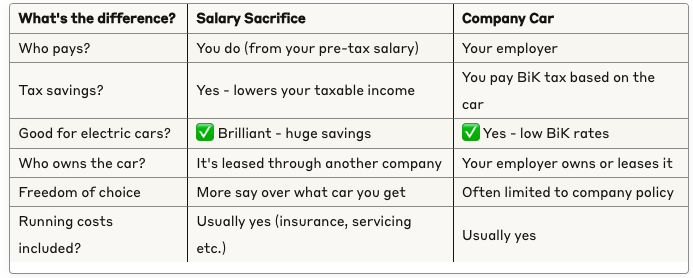

The Main Differences: At a Glance

The Tax Bit for 2025

The tax bit is probably the most important part of deciding which option is best for you.

Salary Sacrifice:

Your taxable salary gets smaller, so you pay less income tax and National Insurance

You still pay BiK, but electric cars can be as low as 2%

Works best if you're in a higher tax bracket (paying 40% tax or more)

Company Car:

Your salary stays the same

BiK tax depends on the car's value and emissions

Electric cars still make good tax sense, but you have less choice

The Good Bits and Not-So-Good Bits

Salary Sacrifice - The Good:

Tax-friendly (especially if you're a higher-rate taxpayer)

You know exactly what you'll pay each month

Really good value if you want an electric car

Everything's included in one payment

Salary Sacrifice - The Not-So-Good:

Affects your pension contributions

You're tied in (and there are fees if you want to leave early)

You don't own the car at the end

Company Car - The Good:

Dead simple - your employer sorts everything

No financial commitment from you

Perfect if you drive loads for work

No need to worry about depreciation

Company Car - The Not-So-Good:

Higher BiK tax if you don't go electric

Limited choice of what cars you can have

You might pay tax even if you barely use it

Which Should You Go For?

Salary sacrifice might be best if:

You fancy an electric car (the tax savings are huge)

You pay higher-rate tax

You like knowing exactly what you'll pay each month

You enjoy having more choice over your car

A company car might be best if:

You do lots of business travel

You want a car without taking a hit on your salary

You're in a lower tax bracket or don't want an electric car

You want the simplest option with no fuss

Wrapping Up

Both options have their perks, but electric cars have changed the game - making salary sacrifice really attractive for tax savings and convenience. If you can choose between the two at work, it's worth doing a quick number-crunch based on your own situation.

Questions People Often Ask

Is salary sacrifice better than a company car? It really depends on you! For electric cars and higher-rate taxpayers, salary sacrifice often saves more tax. Company cars are simpler but usually come with higher BiK tax unless you go electric.

Can I get any car through salary sacrifice? Not always. Most schemes focus on new, low-emission vehicles, especially electric and hybrid cars.

Will a salary sacrifice car affect my mortgage application? It might slightly reduce your official salary, but most mortgage lenders understand these schemes and will take this into account properly.

What happens if I leave my job? This is the big question! If you leave, you'll either need to give the car back (and possibly pay some fees) or sometimes you can take over the payments personally. It's definitely worth checking this before signing up.

Can I put a private plate on a salary sacrifice car? Usually yes! You'll just need to go through the proper process and let the leasing company know.

Book a call with one of our experts We're on hand to help with any questions you might have about salary sacrifice or company cars.

What's next?

Enjoyed this? Read our latest news

Salary Sacrifice vs Company Car

Not sure whether to opt for a salary sacrifice car or go with a traditional company vehicle? We unpack the tax rules, cost benefits, and ideal use cases to help you decide—with a spotlight on electric vehicles.

Our Best Car Leasing Tips

Leasing a car can be a smart financial move—if you know what to look for. In this post, I share my top car leasing tips from years of experience in the motor trade, including how to avoid hidden costs, choose the right contract, and make the most of your lease.

Is It Best to Lease or Buy a Hybrid Car?

If you're considering a hybrid car, you might be wondering whether it’s better to lease or buy. Leasing offers lower upfront costs and no depreciation worries, while buying means full ownership. In this guide, we compare the pros and cons of leasing vs buying a hybrid car to help you make the right decision.

Customer Stories

We've helped over 1,000+ customers find their dream car, hear what they have to say.

Read more reviews“As usual, top class service. The team at Motorlet provided first class service from beginning to end with the friendly helpful expertise of Josh and Wendy. Will continue to use their services as I have done for the past six years...” Keep reading

Diane Parish | Audi Q5

New deals weekly

Subscribe to get the latest offers, guides, new, and more, straight to your inbox.